RIVERDALE, Utah – May 14, 2021 – America First Credit Union announced winners of the $5,000 grant awarded to ten K–12 teachers elevating youth financial literacy in Utah and Nevada. The grants will help fund projects for teachers.

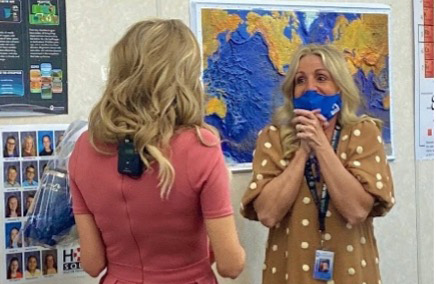

To wrap up Teacher Appreciation Week, May 3–7, America First Credit Union dropped by West Point Jr. High to surprise Kristy Larsen with a congratulatory announcement.

The following teachers, who are using the free FUNDamentals financial literacy program in their classrooms, have received $500 grants:

Utah

- Jacquelynn Merritt Lowder, Belmont Elementary, Alpine School District

- Mindi Barnes, Boulton, Davis School District

- Megan Barton, Bountiful Jr. High School, Davis School District

- Jesse Jones, Syracuse High School, Davis School District

- Ashley Sawyer, Bluffridge Elementary, Davis School District

- Kristy Larsen, West Point Jr. High, Davis School District

- Monika Anderson, Quest Academy Charter School, Weber School District

- Danielle Kingdon, North Davis Preparatory Academy

Nevada

- Savanna Brister, Amplus Academy

- Adry Kewish, Amplus Academy

“America First Credit Union’s commitment to education is unwavering,” said Thayne Shaffer, president and CEO of America First. “We are delighted to celebrate teachers via our teacher grant contest and we will continue to make financial literacy easily accessible to educators and students.”

An emotional Larsen shared, “I love teaching and I love kids. For America First to give me this opportunity to spend money on my students and things they need is awesome. The FUNDamentals program has prepared lesson plans from America First. All I do is log in and download the hour and half lesson plans. It’s a great tool, especially for a teacher who is short on time.”

Teachers can request access to FUNDamentals by visiting www.education.americafirst.com.

Today’s grant awards are the latest in a series of actions that the credit union has taken to elevate youth financial literacy. In February, the credit union announced FUNDamentals, a customizable financial literacy program created for K–12 students and teachers. (CLICK HERE to read the announcement.) This free program empowers teachers and offers a customizable program, unlike many one-size-fits-all programming dictated by other providers.

###

ABOUT AMERICA FIRST CREDIT UNION

Proudly celebrating 82 years of servicing members and a long-standing history, America First Credit Union has become one of the largest, most stable and most progressive credit unions in the country, and has remained a member-owned, not-for-profit cooperative financial institution. Today, America First has 126 locations, and is the eighth largest credit union in assets in the United States with over $15.6 billion, and the fifth largest credit union in membership in America with more than 1,184,290 members.

MEDIA CONTACTS:

Nicole Cypers

America First Credit Union

801.827.8655

ncypers@americafirst.com

Jennifer López

R&R Partners

702.318.4203

jennifer.lopez@rrpartners.com