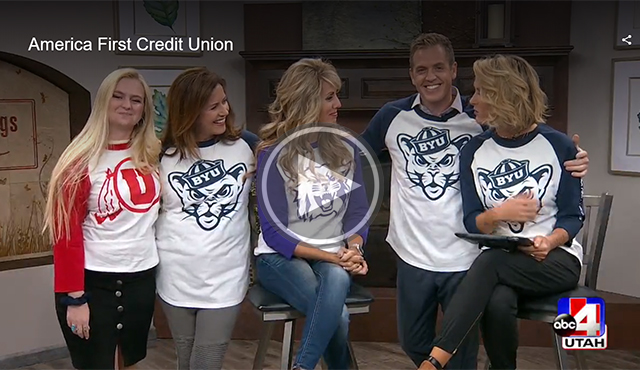

Nicole Cypers from America First stopped by to help support college students as they head back to school.

According to Cypers, “education is very important at America First Credit Union, and we want to not only help you prepare financially while in college, but also welcome you back to school in style.”

That’s why, from August 17th to September 30th, new members attending participating universities: USU, WSU, UVU, DSU, SUU, U of U or BYU, will receive a game day t-shirt when they open a Savings and Checking with a free debit card, and download the America First mobile app.

But they’re not leaving out current student members! They can score a shirt by simply acquiring two of the following:

– Direct Deposit, Online Statements, download our mobile app and make a transfer, download Card Guard and register.

“We love supporting local universities, but even more we want to support students with local financial solutions customized to their needs,” says Cypers. “At America First we believe it is important to start developing healthy spending and saving habits early on. Many students are so young and are not aware of how dangerous debt can be, and we want to assist them and make sure they’re making the best decisions for their future.”

For more information head to Americafirst.com. The website offers handy college planning calculators to determine what you’ll need for college, how much you should save and what loan products from America First might be able to help you.

Aside from the interest rate, what are the most important things to look at when evaluating choices for a credit card?

Aside from the interest rate, what are the most important things to look at when evaluating choices for a credit card?