Riverdale, Utah – (Tuesday, June 5, 2018) – For the entire month of April, America First Credit Union asked members to take advantage of electronic statements instead of paper statements, and pledged to donate $1 for every paper statement canceled during the month to TreeUtah, a statewide non-profit organization devoted to ensuring the health of the ecosystems along Utah. America First is proud to announce they raised $9,767.00 throughout the campaign.

TreeUtah’s mission is to improve Utah’s quality of life for present and future generations by enhancing the environment through tree planting, stewardship and education. With the help of over 155,000 volunteers and donors around Utah like America First, they have planted more than 370,000 trees throughout the state.

Members who switched to the free eStatements now have a secure and easy way to view financial statements that become available on the fifth of every month. It’s an environmentally friendly option that gives them the freedom to see their financial data, anytime and anywhere.

For more information on America First Credit Union, visit www.americafirst.com, or follow America First on Facebook, Instagram, Twitter and Pinterest.

Photos attached:

Nicole Cypers, America First Credit Union PR and Community Outreach Manager presents a check for $9767.00 to Amy May, Executive Director for Tree Utah.

###

ABOUT AMERICA FIRST CREDIT UNION

With a long-standing history and more than 79 years servicing members, America First has become one of the largest, most stable and most progressive credit unions in the country, and has remained a member-owned, not-for-profit cooperative financial institution. Today, America First has 130 locations, and is the 10th largest credit union in assets in the United States with over $9.9 billion, and the sixth largest credit union in membership in America with more than 957,000 members.

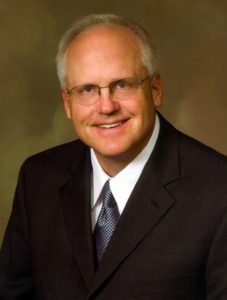

By John B. Lund, President and Chief Executive Officer

By John B. Lund, President and Chief Executive Officer